Finding Clarity: How to Correctly Determine The Home Loan

Regarding buying a home, comprehending your mortgage is one of the most important steps in the process. Many future homeowners feel intimidated by the numerous elements involved in securing a mortgage, from APR to loan terms. It can often feel like a challenging puzzle, but with the appropriate tools and knowledge, you can find clarity in what might seem like a intimidating financial commitment.

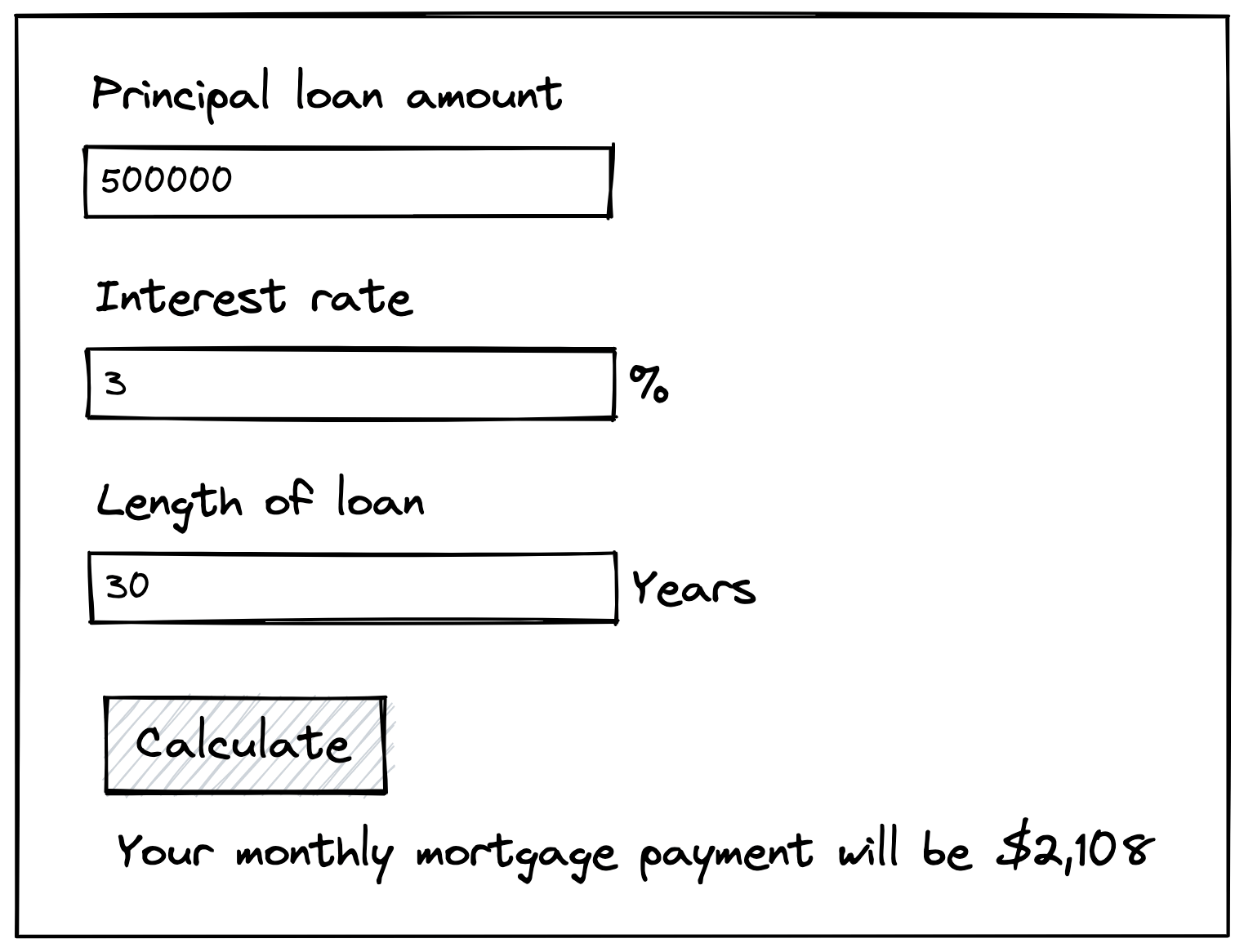

One of the most effective ways to simplify this process is by using a mortgage calculator. This handy tool helps you decompose the numbers, allowing you to see how multiple variables affect your monthly payments and overall loan cost. By precisely calculating hipotecalc.com , you can make informed decisions that complement your budget and financial goals, paving the way for a successful homeownership experience.

Comprehending Real Estate Loan Basics

A home loan is a loan specifically designed to buy real estate, where the property itself serves as collateral. When you obtain a home loan, you commit to pay back the loan amount, plus interest, over a designated duration. Mortgages offer different terms, typically spanning from 15 to 30 years, and the interest rates can be static or adjustable. Comprehending these principles is essential for individuals hoping to purchase a home.

One important component of a mortgage is the principal, which is the sum of cash you borrow from the financial institution. As time passes, as you make monthly installments, you will decrease the principal balance. Another crucial component is the rate of interest, which sets how much extra you will spend for taking the funds. A decreased rate can greatly decrease the cumulative expense of your home loan throughout its lifetime.

In also to principal and interest, many home loans also include taxes on the property and insurance for homeowners in the monthly cost. This collection of costs is often known as PITI, which denotes Principal, Interest, Taxes, and Insurance. Comprehending how these elements work together will aid you get a clearer view of your actual mortgage obligations and allow you to formulate a more accurate budget.

Using a Mortgage Calculator

A mortgage calculator is an indispensable tool that aids potential homeowners calculate their monthly payments based on various factors. By providing the loan amount, interest rate, and loan term, users can acquire insights into what their monthly payments could be. This preliminary calculation can give a clear picture of cost, allowing individuals to make informed decisions about their property purchase.

In addition to the basic inputs, many home loan calculators offer advanced options to include property taxes, homeowners insurance, and private mortgage insurance. This holistic approach enables users to understand the overall cost of homeownership beyond just the loan payment. By considering these additional expenses, prospective buyers can more efficiently prepare for their financial commitments.

Lastly, home loan calculators often include amortization schedules, which break down each payment during the loan's life. This analysis shows how much of each payment goes toward the cost of borrowing versus principal, emphasizing how the loan balance reduces over time. Understanding this information can help homeowners plan for subsequent financial goals and evaluate the benefits of making supplementary payments to pay down the loan faster.

Suggestions for Precise Calculations

To guarantee that your mortgage estimates are accurate, always start by gathering all relevant monetary details. This comprises your loan amount, rate rate, loan period, and any supplementary charges such as property coverage and property taxes. Having accurate data at your access will provide a solid basis for your estimates and help you steer clear of expensive blunders.

Using a dependable mortgage calculating tool can greatly facilitate the task. These calculators can help you comprehend how various factors such as rate percentages and loan conditions impact your regular payments and overall loan charges. Make sure to use an online application or app that allows for customization, so you can enter all your unique details for the highest exact answer.

Finally, double-check your data and check your estimates. It’s common to make blunders in entering data or in the math process. Reviewing your data and discussing with a mortgage expert can provide further assurance that your computations reflect your real mortgage responsibilities. Implementing these actions will give you increased certainty in your financial preparation.